At Redpoint, we’ve had the privilege of partnering with incredible open source companies such as Hashicorp, Cockroach Labs, ClickHouse, and TimescaleDB, and I personally have invested in open source companies like DragonflyDB, Great Expectations, Heartex (Label Studio), Tabular (Apache Iceberg), and ProjectDiscovery. We love open source!

One of the most common questions I get asked by open source founders is “what level of traction do I need to raise for my seed or series A round?” Practically, this raises questions like “Should I focus on stars? How many slack members is a good goal to set? Do I need revenue?”

To shed some light on these sorts of questions, I collected open source traction data from 80 developer tool companies at the time of their Seed and Series A financings (or at the time their financings were announced). To add some additional color, I’ve also combined this quantitative data with qualitative data from having seen hundreds of devtool pitches.

Below, I’ll dig into the primary areas we take a look at when evaluating open source investment opportunities, which I’ve separated into 4 buckets:

Bucket A: Revenue

Bucket B: Open Source Community Momentum

- Stars

- Contributors

- Slack/Discord

- Downloads/User Growth

Bucket C: Quality of Design Partners/Customers and Use Cases

Bucket D: Non-Traction Fundamentals

- Market + Product

- Team + Storytelling

Caveats on the data:

- 80 companies; 69 Seeds; 48 Series A; 11 went straight to Series A without seed.

- The data is imperfect and incomplete - don’t glue yourself too closely to any one metric; some stats are from fundraising pitches, while many are pulled from when their fundraising announcements occurred; thus, the numbers presented are upper bounds of traction as the financings occurred prior to the announcements.

- Of the 69 seeds in the dataset, 54 had open source projects released with stats at the time of financings. I, like many other investors, are more than willing to make seed bets in open source companies pre-product/pre-open-source release (in fact, 2 of the last 3 open source seeds we invested in this year at Redpoint were pre-product).

Let’s get started.

Less than half of the companies comprising the dataset

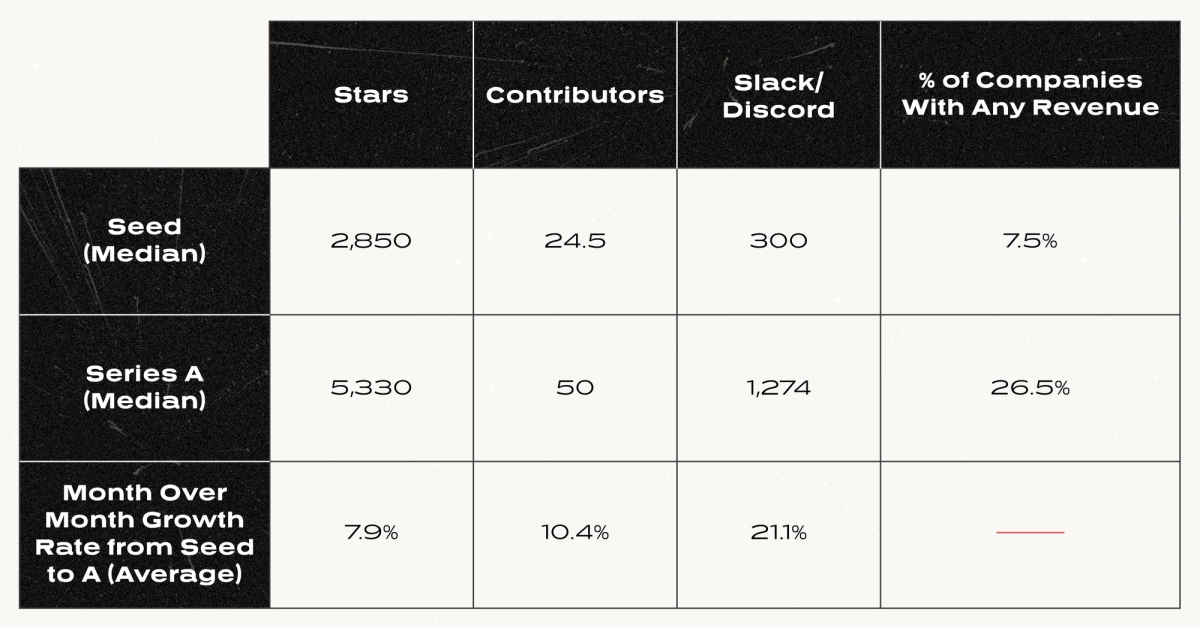

Summary of the data

Bucket A - Revenue:

Some investors will say revenue is one of the most important factors to consider when evaluating an open source company. I say bollocks!

If we look to the 69 companies in the dataset that raised a seed round, at least 49 of them had no revenue at the time of their financings. I strongly believe from what I know of the remaining companies in the dataset that the large majority did not have any revenue at the seed either.

Of the 48 Series A companies in the dataset and the 34 I know of their commercialization at the time of the A, 25 had no revenue at the time of the A. Of the 9 that did, 5 had <$1M ARR.

So what does this all mean? Do VCs not like revenue?! At Redpoint, we tend to view open source companies at the earliest stages like social networks. Building community momentum is of the utmost importance to the success of an open source project, and that often takes precedence over revenue in the short term. If you can show a strong community AND strong revenue growth then you will be in an incredible financing position, but often revenue is not necessary if you have the other criteria in this doc accounted for. If your open source momentum (Bucket B) is weak then you can make up for it by having strong revenue, but there are few examples of successful open source companies that fit this example, as most tend to prioritize community building in the early stages.

Bucket B - Stars:

Let’s start with the most controversial open source metric, shall we? A lot of investors call Github stars “a vanity metric” and “gameable”. While there is some truth to this, VCs clearly do pay some attention to it. For example:

- Many VCs write internal scraping programs to identify fast growing github projects for sourcing, and the most common metric they look toward is stars

- VC still advise their startups when they fundraise to show an “up and to the right” chart of their star growth, and they will still show an “up and to the right” star chart in their internal investment memo

If we look to the actual data:

- Of the 69 seed companies, 54 had released their open source project at the time of their financing. The median value of these projects’ stars was 2850

- Of the 48 Series A companies, all of the open source companies had released their projects by this point in time except one, with a median star value of 4980

- The average month over month star growth rate of the 27 companies in the dataset from seed to series A is 7.9%

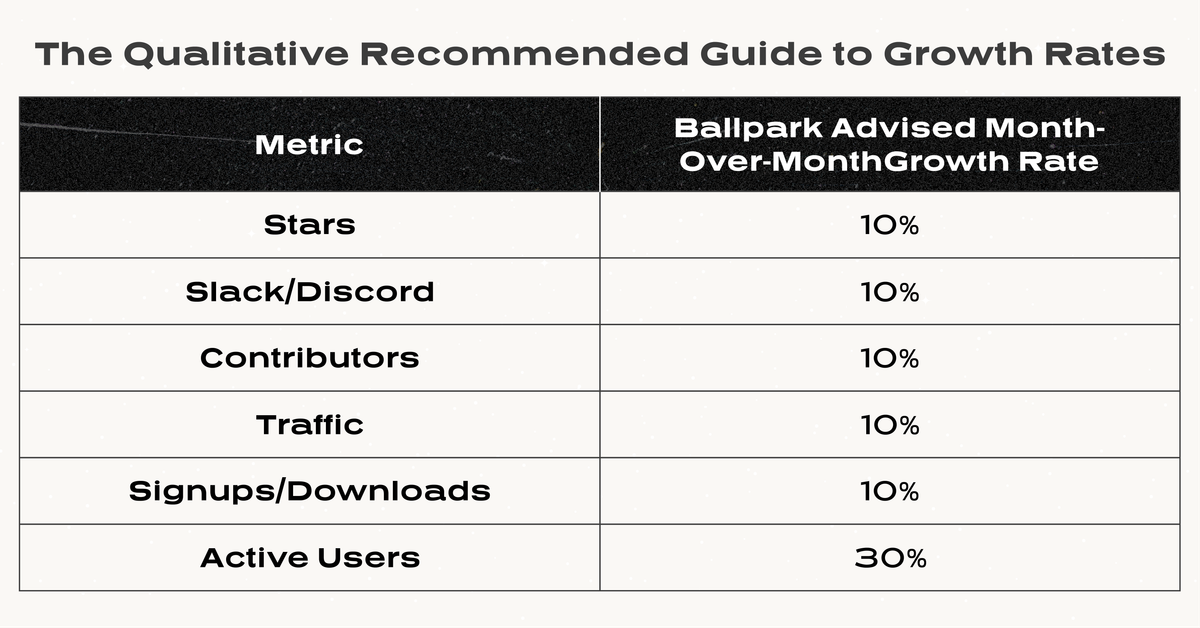

Qualitatively speaking, we tend to advise our portfolio companies that best-in-class star growth tends to be around 10% month-over-month.

Having a lot of stars, or a strong star growth rate, is like having a great resume when applying for a job - it can pique the interest of the person reviewing your resume and get you an interview, but it won’t land you the role. In the same way, stars show VCs there is some semblance of a community around a project to warrant interest in the technology, and thus further examination and time spent. From a traction perspective, stars are often enough at the seed stage, after which companies will then want to show stars and initial interest converting to actual downloads/production usage.

Bucket B - Contributors:

Having a strong base of contributors in the open source community is an effective way to show investors the passion your project holds amongst the developer community. There are numerous benefits to this long-term, as your contributors can fix bugs, contribute requested languages/integrations/SDKs to free up product development work, and can act as strong candidates to hire.

The median value of Series Seed contributor count was 25, while the Series A was 50. The average month-over-month growth rate between Seed and Series A was 10.4%. Like with stars, we’ve tended to see 10% as best in class on average historically, so I am pleased to see this line up to the data!

Personally, if I am going to invest in a company at the seed with an open source project (I have led many seeds that have yet to release one!), I don’t need for there to be a large contributor count as a metric and care more about there being early signs of apparent community interest. This could be contributors, but it doesn’t have to be. At the Series A, there are ideally 15-20+ contributors outside of the company that have contributed to the core repo, but this isn’t a hard and fast rule.

Bucket B - Slack/Discord:

An active, fast-growing Slack/Discord community is one of the best metrics an early stage open source company can show, as it is one of the best indicators of “community momentum” which we will discuss more in depth later.

The median value of Seed Slack/Discord count was 300, while the Series A was 1274 with an average monthly growth rate of 21.1% (median 14%). While a bit lower than the data, like stars/contributors, I have historically advised founders that ~10% growth is an appropriate goal post launch.

Bucket B - Downloads / User Growth:

Sometimes it can be hard to instrument open source traction, but showing downloads can be a strong indicator to a project’s success. However, 10,000 downloads for one project (e.g., an individual engineer’s IDE or linter) can mean something very different from 10,000 downloads of another project (e.g., database). For that reason, I care less about the actual number of downloads and more about the slope of the download/user growth over time (indicator of increased community momentum). Jono Bacon - Author of The Art of Community and People Powered and former Director of Community at Github and Canonical - advises that a startup should aim for 30% active user growth, followed by (can you guess what’s coming?) the tried and true 10% monthly growth for signups and web traffic. Downloads can also be supplemented in other ways, such as in a wall of tweet messages from users loving the product.

Bucket C - Quality of Design Partners/Customers and Use Cases:

What is even more important than the slope is the actual companies/users using the product and their production use case. As discussed earlier, the majority of open source companies at the Seed and Series A historically have not had revenue. Instead, they have had design partners, which are companies that have agreed to be early adopters of a solution (typically a managed offering) in exchange for in depth feedback and - eventually - a discounted annual subscription.

What investors look for here are two fold:

a) The quality of the design partners - for example, if you are a YC startup, having a bunch of other YC startups as design partners is not as impressive as having well funded and respected growth stage or larger tech startups. I hate to admit it, but VCs love their sexy logos.

b) The extent of the design partners and the use case your project is being deployed to solve - is this being used by one engineer, one team, or the whole company? Is this being used in production and as a critical part of the organization’s infrastructure? How many workloads are running on this piece of infrastructure? Is this a solution developers would threaten to quit over if you said you would take it away from them? (a bit extreme, but you get my point)

At the seed, I tend to not expect much in the way of design partners, particularly if there is some semblance of interest in the way of an open source community (e.g., stars, contributors, slack, etc). However, oftentimes seed companies will put quotes from developers at companies that they have interviewed validating the need and approach of their solution, even if they are not secured design partners yet, which is very helpful. At the Series A, it is imperative to have design partners in place, particularly if there are not yet paying customers, and ideally promising tech-forward ones at that.

Bucket D - Market + Product

There isn’t anything unique about open source for this one, but fortunately many markets in developer tooling are quite large (e.g., databases, observability, etc). With that said, given public markets are down and greater scrutiny is being given here, founders must be able to show greater future expansion opportunities across personas, use cases, and product lines. Remember, many firms underwrite investments with the goal of an IPO - and thus require a multi-billion dollar outcome.

Part of assessing the market opportunity is why your product is better than competitive offerings. This can be a myriad number of reasons in open source - e.g., having better DX, being able to host on-prem and have privacy/security benefits, benefits of open source and being code-visible to tailor to developers, being bottoms up and having the community contribute open source components/integrations back to the product, etc.

An important note is that - even if a company focuses on open source community building to start and bottoms up / low ACV adoption to start - nearly all enterprise companies on the path to IPO end up resorting to top-down enterprise sales and larger ACVs as part of their strategy at some point (for example, Hashicorp at IPO had an ACV of $140k, with 58 companies paying >$1M+ to comprise a sizeable portion of their overall revenue). Therefore, companies will still need to demonstrate that they will be able to grow into larger enterprise ACVs in the long term. I have a piece demonstrating this in excruciating detail coming out next week!

Bucket D - Team + Storytelling

You’ve no doubt heard the term Product-Market Fit before, so I’ll throw a new one at you that we like to use at Redpoint called Founder-Market Fit. It refers to how uniquely qualified a founder is to serve the needs of a particular market given their background and experience. In other words, of all the people in the world that could be solving this problem, why should an investor bet on you?

Storytelling refers to the ability to communicate in a compelling manner why you are the right team to tackle this problem (your founder-market fit), why your solution is the right approach, and why this is a large IPO-able company. In other words, it’s how well you give your pitch.

It is these two things that can overshadow any traction deficits. If the team is truly spectacular and experienced, and is able to convey a large market, then investors are more willing to overlook how far the company is in terms of progress, and in many cases at the seed invest pre-product.

The qualitative recommended guide to growth rates

So what do you need to raise and where should you focus?

So we’ve gone through every metric, explained what investors look for, and gone through the data. Let’s bring it all together and consult our favorite buckets:

Bucket A: Revenue

Bucket B: Open Source Community Momentum

- Stars

- Contributors

- Slack/Discord

- Downloads/User Growth

Bucket C: Quality of Design Partners/Customers and Use Cases

Bucket D: Non-Traction Fundamentals

- Market + Product

- Team + Storytelling

In summary, to raise a successful a Seed, one of the following sets of buckets must be satisfied:

Successful Seed = D (if really strong by itself)

(or) = at least one of B’s sub bullets + D

(or) = C + D

As mentioned before, if bucket D is very strong, then founders can bypass A-C altogether and raise a seed round prior to any traction. If the team is less experienced or it is a more unproven market, then they may want to prove out their open source traction (Bucket B) or secure strong Design Partners (Bucket C) first prior to raising their seed.

To raise a successful Series A, you typically need to satisfy the following set of buckets:

Successful Series A = B + C + D

Bucket A is beneficial in both cases but often not required, and can be added in to account for deficits in other buckets. As the data shows, every single company (except for one) had released their open source project by the Series A, indicating that open source traction is necessary by the Series A and revenue by the Series B. However, what has been the case for the last 3-4 years may not be the same going forward, and the bar for Series A - and in turn revenue expectations - may increase as a result of the market. I will report back in future pieces if expectations change here.

And that’s all! If you’ve made it this far, hopefully you’ve learned a bit about how VCs evaluate open source companies, and have a bit more data about what traction looks like at the Seed and Series A. The important thing to remember though is that Venture at the early stage is an art - not a science. No VC is going to not invest in a company because they have 1500 stars instead of 2000, or 800 slack members instead of 1200. Don’t take any given number in this doc too seriously, but take the collective ideas as guidance as you think about your goal setting and fundraising plans, and above all, have fun :)

Have questions or want to chat? Follow me on Twitter @jordan_segall and on my substack!

Want some tips on growing your community? Check out my colleague Pat Chase’s excellent piece on strategies to obtain your first 1,000 community members.