“We added a record 212 new large customers, those paying us more than $100,000 per year and now have 1,749 customers over that threshold. These large customers [1.1% of customers*] now represent 60% of our revenue, up from 50% six quarters ago. This trend illustrates how large established enterprises increasingly formed the foundation of cloud business.”

- Cloudflare Q2 2022 Earnings Call Transcript.

One of the most valuable lessons I learned when entering venture capital was that I should always ask myself when evaluating a new investment whether I could envision an S-1 (the form that must be filed by companies when they go public prior to an IPO) for the company. Intrigued by what this meant at a more granular level, I began to explore the common traits of developer tool / cloud infra companies that go public. Specifically, in this world of “bottoms-up” and self-serve, can devtool companies go all the way to Wall Street on such a sales motion? Do I need to expect a company I am considering investing in to be able to close hundreds or thousands of $100k+ enterprise contracts or even $1M+ contracts in order to go public?

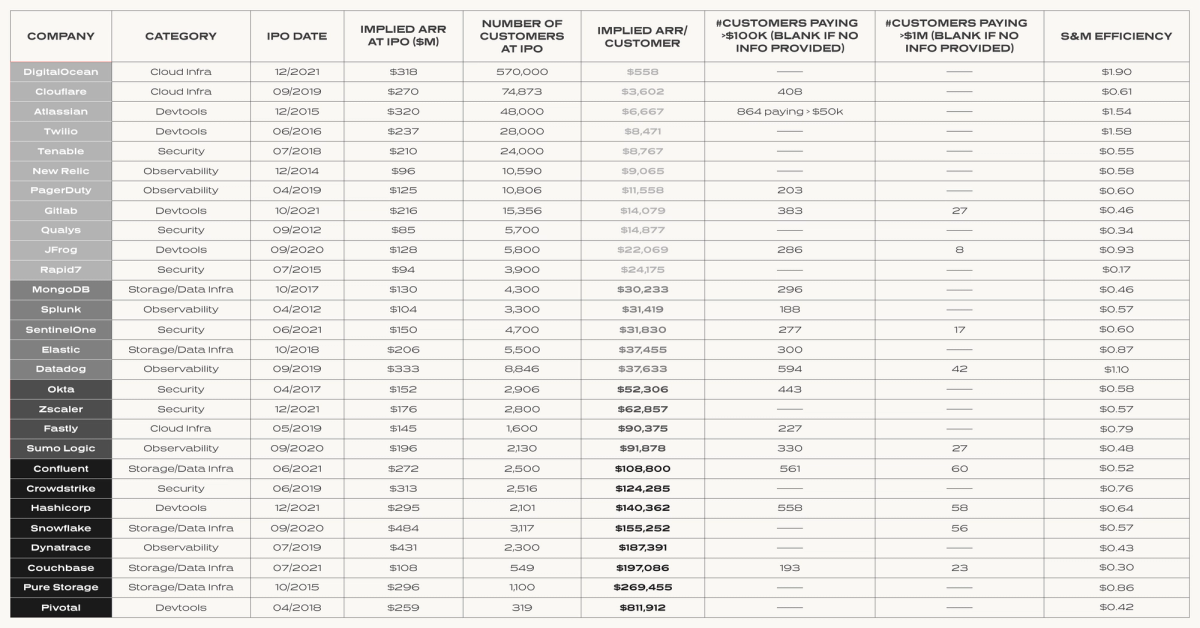

In an effort to answer this billion dollar question, I took S-1 data from every major devtool company I could think of that went public in the last decade (28 of them) to add some color to these questions:

The first level of insights we can derive from the data are:

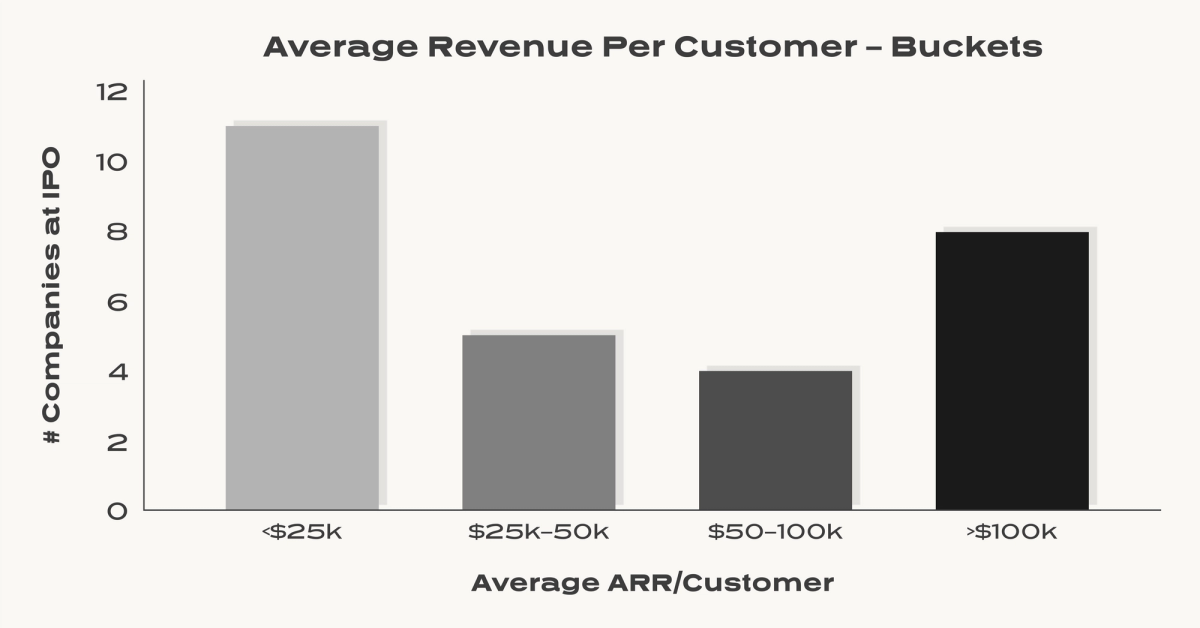

- First, of the 28 companies, the average ARR/customer (which I’ll refer to as ARPU, or average revenue per user, going forward) was $92k and the median was $35k.

- 8 companies had an ARPU >$100k, 4 between $50k-$100k, 5 between $25k-$50k, and 11 that were <$25k.

Digging a level deeper, we notice some interesting findings. Despite there being many companies with relatively low ARPU:

- 21 of the 28 companies stated a metric in their S-1 for the number of paying customers with contracts paying $100k+/year (median being 300)

- At least 10 specified the number of customers paying >$1M+/year (median being 27) - though likely many more did but simply did not specify having such contracts in the S-1 form.

- Interestingly, nearly all of the lower ARPU companies had many >$100k+ customers, with at least 4 of the 11 companies in the lowest <$25k ARPU bucket specifying $1M+ customers.

What this means is that, even for companies with large swaths of bottoms up customers and lower ACVs, a top-down sales motion and larger-ACV strategy is nearly always added to a developer tool company’s strategy prior to going public. Furthermore, these small number of enterprise customers typically account for sizable portions of a company’s overall revenue. This becomes even more prevalent if we examine the <$25k ARPU public companies at an individual level to see the impact those larger contracts had on the business’ abilities to go public:

- JFrog: Their customers paying >$100k ARR (4.9% of customers) comprised 48% of ARR

- GitLab: Despite having 15k+ customers, 60% of their revenue came from their enterprise customers, with 383 paying >$100k and 27 paying >$1M

- Tenable: Enterprise Accounts (18% of customers) comprised 72% of revenue

- Atlassian: There were 864 customers paying >$50k. Without further info, all this implies is that these 1.9% of customers accounted for at least 16.25% of revenue (likely far more though since this assumes they all only paid $50k each)

- Cloudflare: As the quote at the beginning noted, Cloudflare stated in their Q2 2022 earnings that 1749 customers - only 1.1% of their total customers - comprised more than 60% of their revenue.

- DigitalOcean: While I don’t have the data at their IPO, 15% of their customers in 2022 paying >$50k comprised 83% of revenue

Looking outside of the lowest bucket, we continue to see the effects that large enterprise contracts have on devtool company’s abilities to go public:

- DataDog: With an ARPU of $37k, their top 10 accounts (0.1% of customers) comprised 14% of revenue and their accounts paying >$100k+ (6.7% accounts) comprised 72% revenue

- Fastly: Their top 10 (0.6% customers) comprised 32% revenue, and their top 14% of customers comprised 84% of revenue

- Snowflake: Their $1M+ ACV customers (1.8% of total customers) comprised 47% of revenue

If we examine the companies by category, we see what we’d expect, with Median ARPUs being lowest and Median Total # of Customers being highest for Cloud Infra and Devtool companies relative to Observability, Security, and Storage/Data Infra – though, as discussed with Cloudflare, Fastly, Atlassian, Gitlab, and DigitalOcean, all sectors are still significantly impacted by enterprise contracts.

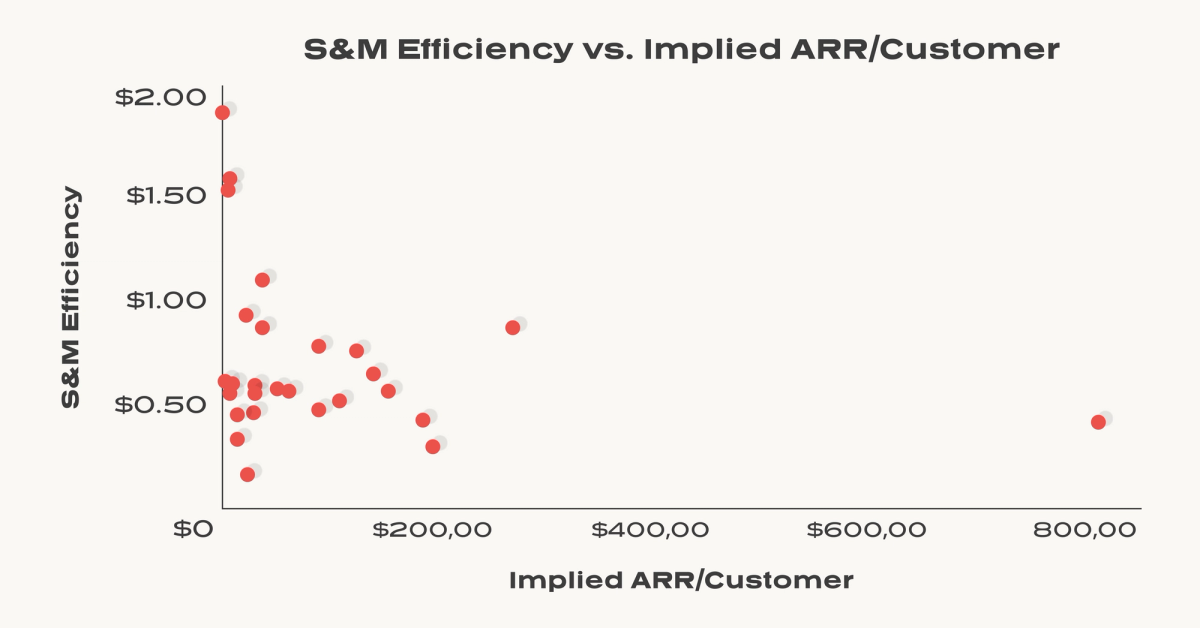

Finally, if we look at the sales efficiency for each company against their ARPU, we see….not that much correlation, implying that both low-volume/high ACV and high-volume/low ACV types of business require high sales and marketing spend typically. However, we do see some very high sales efficiency for some of the low ARPU ones like DigitalOcean, Atlassian, and Twilio, which demonstrate that even if these businesses still needed to add on enterprise sales eventually, they were able to do so in a very capital efficient manner.

So does this mean as an investor I stop investing in bottoms up devtool companies? 10000% no (if 100% wasn’t clear enough!). It’s one of the most effective forms of growing an early stage business in a capital efficient manner. However, in most cases, I do need to see the potential for there to be several hundred businesses paying $100k+ and in some cases the potential for even $1M+ contracts down the road. After all, we’ve seen just how much $$$ enterprises are willing to shell over and how much they can comprise a business’ total revenue!

__

Whether you are a bottom-up or top-down business, we at Redpoint would love to chat. Follow me on on Twitter @jordan_segall or follow my substack.