While rumblings of recession risks continue to captivate headlines, the US employment landscape has, in reality, never looked better. With the unemployment rate of 3.4% now sitting at 50 year lows and new business starts up over 40% since 2019, business owners across industries today are feeling a renewed sense of urgency when it comes to delivering greater operational efficiency, transparency, and customer delight in the race to keep pace with the accelerating competition around them. Enter vertical SaaS. Over the past several years, a Cambrian explosion of vertically focused companies have emerged aiming to transform the last bastions of pen and paper, fax machines, and error-prone manual tasks that can not only be done better but also faster and cheaper through technology. We’re excited about the potential for these companies to revolutionize the way that work gets done across a broad base of multibillion, if not trillion, dollar industries.

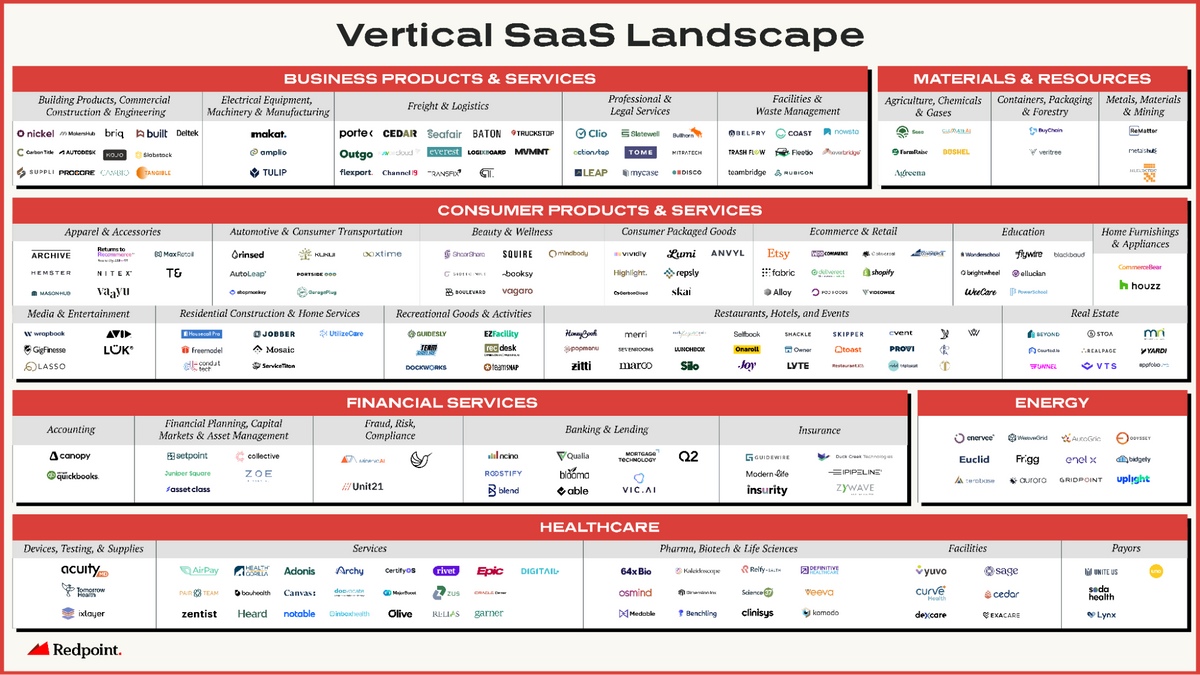

In this series, we unpack the “what,” “why,” and “how” defining this generational shift as well as our perspectives on the category after studying it closely over the last several years. In this first post, we’ll share our perspective on what classifies as vertical SaaS (and, importantly, what does not), why we’re excited about the category, and a market map of the current landscape. In future posts, we’ll dive into why we believe there has never been a better time for vertical specific solutions, what common traits we’ve seen from the winners, and what we’ve learned from category breakouts.

What Is Vertical SaaS?

At Redpoint, we define vertical software as a service (SaaS) as companies that are building software purpose built for a specific industry (e.g., construction, restaurants, financial services, etc.). Ideally, this software becomes the core workflow for users -- the business critical operating system used to run their business.

Importantly, for the purpose of this piece we also want to clarify what is not vertical saas in our opinion. Though others may define it differently, for our mapping we have not included marketplaces and tech enabled services in our definition. Marketplaces primarily have a transactional business model unlike vertical saas that charges a recurring fee for software. Services are often vertically integrated or have technology to drive efficiency on the back end which is largely not exposed to the end user. We also wanted to parse out usage based SaaS and APIs and focus solely on more traditional SaaS models that are based on a platform or per seat fee. This is not at all to say these other business models are not interesting or viable, just different from the ones we’re looking at for this piece.

Why We’re Excited

While “delighting the user” is an important goal, and often rallying cry, among venture backed tech companies, this impact is outsized in dustier industries where the delta in experience is massive relative to the consumer software users have in their personal lives. Why shouldn’t booking and paying for your car repair be as easy as ordering food delivery? As we’ll dive into below, we believe there is a unique opportunity for vertical SaaS solutions to improve efficiency, enhance the user experience, and improve economics in industries that are traditionally slower to adopt software or are working with legacy systems today. In addition, by building workflow customized to the needs of an industry, the high applicability should drive greater adoption and far higher penetration in these markets over time.

Increased efficiency

Verticalized SaaS enables businesses to streamline their industry specific operational workflows – particularly those burdensome and historically analog activities that not only take an outsized amount of time but are also highly prone to error. Can you imagine transcribing thousands of faxes with messy handwritten orders? The introduction of new software can not only improve productivity, but also enhance the user experience and drive higher margins (if not revenue as well). Over time, there frequently becomes further opportunity to layer in automation and data driven recommendations. Given these characteristics, when successful, vertical software solutions are incredibly sticky, mission critical, and therefore have a far lower likelihood of displacement given their positioning as core workflow. ServiceTitan has done this incredibly effectively for trades businesses – enabling an HVAC vendor, for example, to better manage their customer pipeline, schedule jobs, and invoice. And we suspect there are tens, if not hundreds, of other potential category captains poised to emerge as other analog industries enter the digital age with the support of similar purpose built product suites.

Improved customer experience & employee retention

By streamlining workflows and increasing transparency, vertical SaaS improves the experience of not only the users of the software (typically small business owners and their employees) but also their end customers – talk about a win-win. Because such solutions frequently enable businesses to offer more features or services to their customers than they otherwise would, business owners are able to deliver more personalized experiences, boosting both customer NPS and retention rates over time. Here, MindBody serves as a great example – with Mindbody’s platform, fitness studios are better able to engage with their customers by seamlessly showcasing their class availability and a broad base of booking and package options while also enabling dynamic booking in real time.

As we’ve alluded to, this improvement is also incredibly valuable to the overall employee experience – an area of increasing consideration for business owners. In a ruthless employment market, improving a user’s experience and therefore occupational NPS is key to overall retention. With annual turnover rates surpassing 100% in many of the categories we unpack below, even marginal improvements in retention can lead to material savings in overall hiring costs. With Veeva, for example, sales reps have greater access to customer information and medicinal drug data, enabling them to sell more efficiently and delightfully while also earning more. With greater access to data than ever before, these connected data advantages will only accelerate.

Higher penetration rates & stickiness

Given the purpose built nature of industry specific solutions combined with their very targeted go-to-market motions, we believe vertical SaaS companies can achieve materially higher market penetration than their horizontal counterparts. This focus should also drive down acquisition costs while enabling best in class retention given how well suited the software should be for an industry specific workflow. To emphasize this point, it’s worth highlighting Shopify, who today powers close to 29% of all ecommerce websites – a virtually unheard of penetration rate. By ruthlessly focusing on the specific needs of their core customer and refining their go-to-market motion with this very specific buyer in mind, this $63B behemoth has been able to increase its number of customers (in this case, retailers) by close to 54x over the past 10 years, while also expanding its number of use cases and associated ACVs within this buyer base. This is incredibly exciting for investors and founders alike as it unlocks markets that were previously perceived as being “too small” based on traditional penetration rate assumptions.

Improved economics

As a result of the three characteristics outlined above, vertical software has the ability to drive improved economics for its users – the holy grail of value props. While customers’ costs decrease because of increased employee productivity, higher retention, and fewer costly mistakes, we expect revenue for these businesses to rise as well, boosted by better customer engagement, higher retention, and perhaps even upsell opportunities unlocked by embedding an array of financial services that directly address the needs of their customers (could we really publish a VC blog post without out at least alluding to the possibility of turning every business into a fintech company?!).

Across industries, with the big getting bigger, these sorts of platforms are enabling the long tail of individual operators and SMBs to keep pace – and we couldn’t be more excited about their potential to level the playing field. So, you might be asking, who are they?

And how did we land here?

Given the diverse (and, at times, controversial!) nature of this sector, there are virtually an infinite number of potential categorization methodologies. Our map showcases just some of the many companies in every vertical and is by no means exhaustive. We ultimately decided to place companies where we thought most honored the very nature of the industries they are transforming. And we’re interested and eager to hear your feedback on who the next generation of category captains across these verticals might be.

For us, this foundation is only the beginning. We’re excited to dive into Why Now, What Makes Us Excited, Learnings from Success Stories, and more in future posts. Stay tuned and in the meantime, drop us any thoughts in the comments or via Twitter (@itsmeeraclark & @mkhandel). We’d love to hear from you.