As climate conservation emerges as the key consumer conversation of the decade, consumers today expect businesses to play an increasing role in the environmental equation. With the accelerating adoption of regulatory measures at both state and federal levels like the Sustainability Reporting Directive (CSRD), Bipartisan Infrastructure Law, Inflation Reduction Act, and Local Law 97, to name a few, executives today have little choice other than to address their environmental footprint and exposure. Companies agree. 89% of executives acknowledge a global climate emergency, and 60% of the Fortune 500 ranging from Amazon and Coca Cola to Walmart and Disney have already expressed a commitment to addressing the climate crisis. This pledge underscores significant potential given the group’s sway over suppliers and policymakers alike. With the number of companies committing to net zero targets tripling in the past year alone, few topics are receiving as much universal attention across board rooms as sustainability is today.

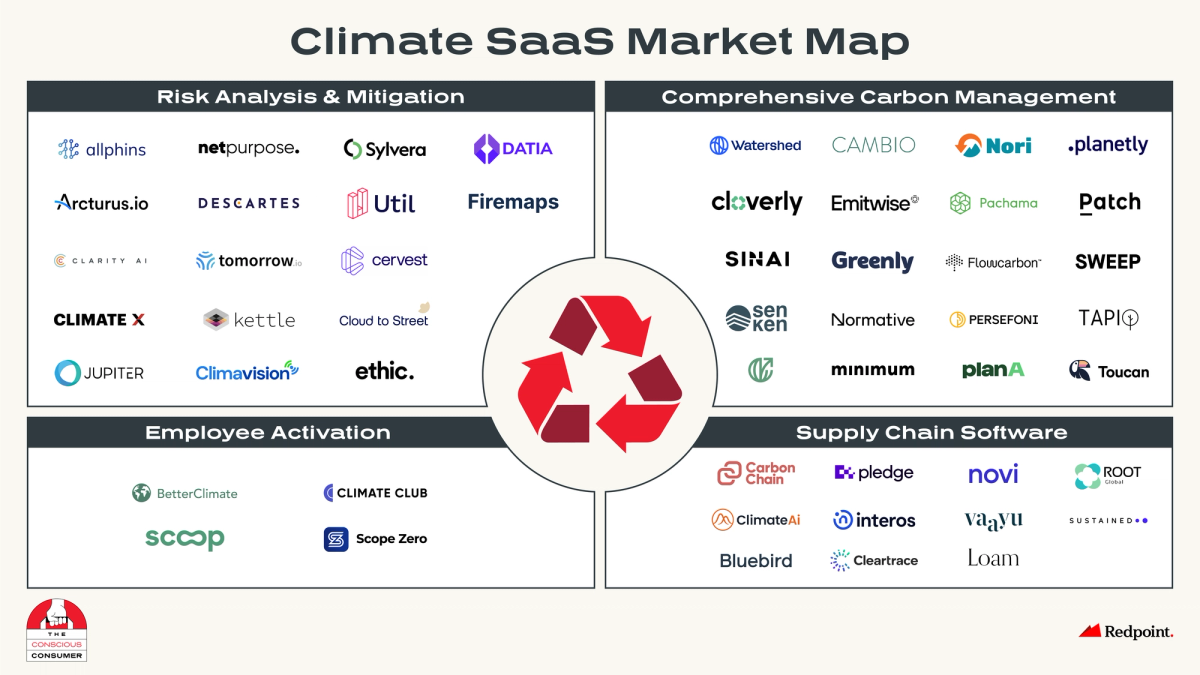

Yet we’ve seen that intention does not always equate to action. Despite these commitments, few companies today are equipped to meet their ambitious sustainability targets. While setting these targets starts with auditable emissions accounting and an understanding of one’s end-to-end environmental impact, it extends far beyond into the branches of both offsets and, more importantly, reduction. Without all three, it is challenging to imagine a path towards carbon neutrality. Thus, we at Redpoint believe an emerging ecosystem of environmentally-oriented B2B solutions holds the key to making these corporate commitments a real world reality. As we dream of a world defined by more climate-conscious companies, we’re excited about opportunities in the following categories.

The Toolkit for Transformation —

1. Comprehensive Carbon Management.

With net zero commitments and regulatory pressures continuing to compound, we believe companies are likely to begin treating emissions analysis and mitigation as a core business cost. With roughly 2 in 3 asserting that effective ESG measurement remains a key barrier to their sustainability journey, we expect Measurement, Reporting, and Verification (MRV) platforms that attempt to more accurately calculate and analyze emissions baselines to continue to proliferate. These will likely serve as the foundations on top of which companies will layer on sustainability-oriented Enterprise Resource Planning platforms (ERPs).

Yet, as regulatory scrutiny surrounding the accuracy of these estimates increases, data breadth (though the establishment of robust integrations capable of accurately pulling in company specific reports) and enhanced analytics are likely to serve as a stronger and stronger moat for category leaders over time. While accounting and analytics are essential to understanding the scope of enterprises’ sustainability challenges, true progress will only come through the introduction of actionable and auditable recommendations. This will likely include a mix of offset and reduction oriented approaches in the near to medium term.

• As sophistication and industry-wide adoption accelerates, what technical capabilities will be required to transition from today’s costly consulting based status quo to a paradigm defined by more resource efficient digital diagnostics?

• Might we see the emergence of greater standardization and streamlined sharing of reporting – a Carta for climate of sorts?

• And to what degree and at what speed will applications extend to the adjacent built environment, which today is facing similar – yet arguably underappreciated – regulatory pressures at both the municipal and state level?

2. Supply Chain Software.

Historically, supply chains have been built for efficiency — not resiliency. However, C-suites are starting to rethink this approach in light of growing climate risks and regulations.

Supply chains frequently represent the most meaningful source of emissions for large companies and account for roughly 60% of emissions globally. Yet, with most supply chain emissions categorized as scope 3, effective measurement represents a persistent challenge, with only 16% of corporations reporting an ability to do so effectively today.

Nonetheless, the desire — and need — to do so are increasing. Some 49% of CEOs report they’ve had supply chain interruptions due to climate-related events and 75% of them are implementing efforts to digitize their supply chains. And the cost of supply chain decarbonization is surprisingly manageable. A study from BCG suggests that full decarbonization would result in end consumer price increases of only 1% to 4%. The unanswered question for many remains “how?”

Today, a wave of vertically oriented solutions is emerging that supports everything from sustainability-oriented design and procurement strategies to the establishment of higher-integrity data collection and analytics efforts.

• Moving forward, will rising risk or regulation emerge as the key accelerant to the coming decade’s supply chain transformation and how will this shape both pricing and product prioritization?

• Will industry-specific nuances result in the broader proliferation of siloed, vertically oriented solutions or will data and analytics advantages favor the emergence of one or two horizontal market consolidators?

3. Risk Analysis & Mitigation.

Both companies and financial markets are most efficient and stable when participants are able to make well informed decisions. Climate change, however, is creating an alarming and expanding array of indeterminate financial risks. While studies suggest that roughly 200 of the world’s largest companies face close to $1 trillion in climate-related risk, roughly 52% of companies assert that their warning systems for climate risk events are inadequate or non-existent.

Today, 93% of investors surveyed believe climate-related financial risk “has yet to be priced in by all key financial markets globally.” As a result, asset managers are increasingly calling for mandatory climate disclosure rules to enhance their ability to effectively manage their investments, and large multinationals like Walmart and FedEx are similarly expressing support for mandatory SEC reporting.

As countries, corporates, and investors alike seek to better quantify and mitigate their climate exposure moving forward, we expect to see a broadening base of CFO- and CIO-driven initiatives. These might include enhanced scenario analysis leveraging AI powered demand forecasting to actionable transition planning spanning autonomous and remote operations, route optimization, development of reverse logistics capabilities, sustainable packaging, and more.

• As these efforts come to fruition, could we see sustainability departments gain greater financially linked accountability, driving expanding budgets and attention?

• Could climate become as paramount to companies as cyber?

• And will training and hiring practices evolve to ensure adequate experience and / or subject matter expertise in this emerging field of focus?

4. Employee Activation.

Given labor’s role as a critical resource constraint facing companies today, it should come as little surprise that companies are getting creative to invest in talent. With more than 40% of Millennials and Gen Zs exerting pressure on their employers to take steps to reduce their environmental footprint, sustainability benefits are a growing category within the benefits stack. From providing training and incentives surrounding more environmentally-friendly actions to launching employer-sponsored carbon neutral commuting programs, the range of approaches continues to expand as the category grows.

While many of these benefits were originally proposed as a result of employee interest, employers are now finding that they too could capitalize on the trend thanks to their attributable scope 3 emissions reductions — a win-win for companies struggling to close the gap to their distant carbon neutral targets.

Over the past few quarters, we’ve seen an emerging cohort of climate-conscious benefits providers positioning themselves to empower both employees and employers to demonstrably reduce their carbon footprints.

• Looking ahead, could sustainability benefits become as prevalent as workplace wellness programs for progressive employers eager to engage employees on the topics that matter most to them?

• And what sort of enhanced data collection capabilities for these climate conscious offerings might be needed to validate optimists’ early hypotheses surrounding longer-term emissions reductions claims at the employer level?

The most rewarding milestones are often the most challenging to reach. I suspect that companies’ commitment to climate conservation will be no different. Yet, with many of the most brilliant minds of our time dedicating their lives to this critical cause, I am hopeful that we’ll be able to reverse — or at least meaningfully slow — our collective course.

If you’re as excited about transforming the toolkits for climate conscious companies as we are, we’d love to hear from you. Find me on Twitter at @itsmeeraclark or subscribe to my Substack for more.