Cloud Infra Public Markets Update: 2025 InfraRed Report

How have publicly traded infrastructure companies fared over the past 12 months?

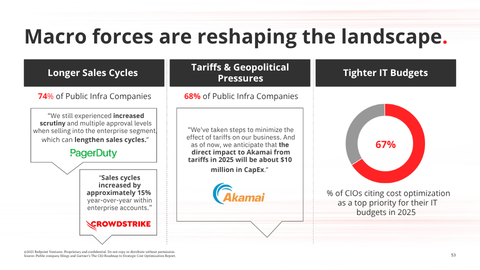

For the most part, it’s been a difficult year for publicly traded infra names. The three common macro headwinds for these companies are...

- Longer sales cycles - sales cycles have increased 10-15% for 75% of all publicly traded infrastructure software companies

- Geopolitical pressures namely in the form of tariffs. Nearly 70% of the public infra universe has eaten millions in costs to tariffs

- There is a reduced appetite to spend on 3rd party software. 70% of public company CIOs are cutting their IT budgets

And it shows up in company fundamentals.

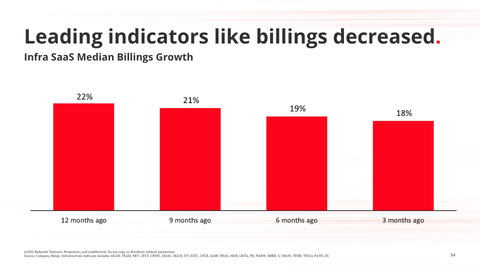

This chart shows the median billings per quarter for publicly traded infra software companies, which is a good leading indicator for future growth expectations.

As you can see, it’s been decreasing QoQ in the past year.

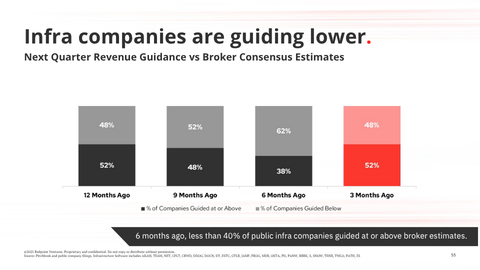

It’s the same with guidance.

This chart shows the median revenue guidance of publicly traded infra companies.

6 months ago, only 38% of infra companies guide at or above broker estimates.

These levels are close to what we saw in the 2022 pullback.

That said, this past quarter’s data is looking more promising or at least it’s stabilized a bit. Why is that the case?

Well, it’s mostly that these companies have lowered their future revenue projections so much that they have more achievable targets.

Despite everything going on in the macro, there is a bit of optimism here. Public market investors are cautiously optimistic of this trendline but by no means have we turned a corner yet.

But there are some tailwinds…

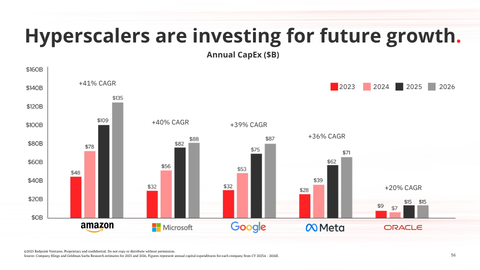

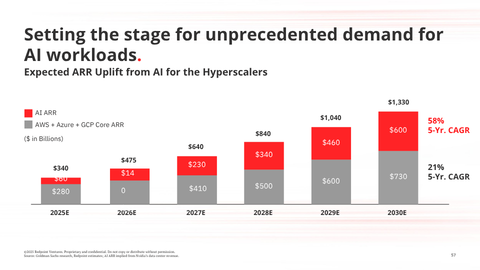

A good leading indicator of the infrastructure market in the long term, is the capex investment of the cloud hyperscalers.

The above chart shows the annual capex figures for AWS, Microsoft, Google, Meta, and Oracle.

These companies will pay a staggering $400B in hardware infrastructure and capex in 2026 which is a record high and a good leading indicator for expected growth.

It’s clear the capex investment is to set the stage to capture the AI tailwind at our backs.

There will need to be a massive investment in infrastructure to enable the AI transition.

For example, AWS’s AI revenue eclipsed $100B in 2024.

It’s estimated that revenue from AI-based products and initiatives for the hyperscalers will drive over $600B in top-line revenue to the hyperscalers in 2030 and overtake their core business sometime in the 2030s.

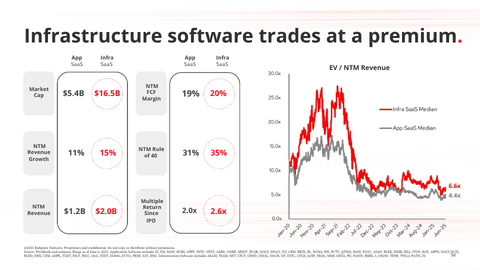

When we look at fundamentals like total revenue, revenue growth, and FCF margins across the board, infra companies outperform application ones.

It’s why infra companies on average, return higher in the public markets relative to application software companies and why there is a 2x turn premium to how infra companies are traded relative to app software companies.

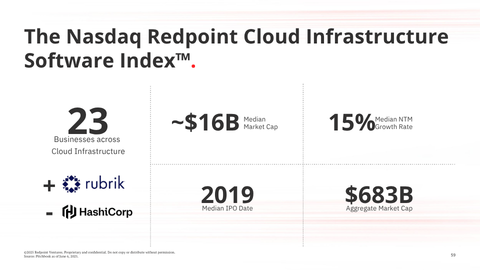

That’s why 2 years ago, we created a pure-play index on just the publicly traded infrastructure software companies.

We have 23 publicly traded companies in the index across data infrastructure, cybersecurity, and developer tools.

A couple of changes in the past 12 months - HashiCorp, one of Redpoint’s very own portfolio companies - was acquired for $6.4B by IBM.

Rubrik (a leader in cloud backup and recovery) had a great IPO and has traded over 2x higher and is now an $18B business that is part of our index.

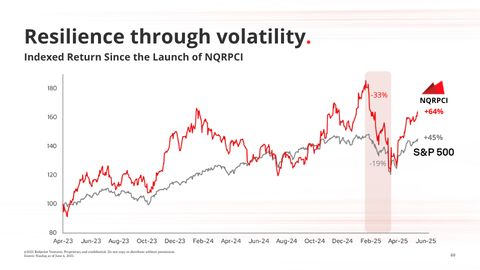

Let’s look at how the index has fared.

As you can see, it’s been quite volatile and choppy since we launched 2 years ago.

At the beginning of 2025, we were up nearly 90%. The S&P was up 45% through that same time-period.

But due to the tough macro and related issues at the beginning of the year, the index dropped over 30%.

That said, in the past several weeks, the index has corrected a bit and overall, we are up 65% over the past 2 years relative to S&P is up 45%.

This trendline mirrors what we’re seeing at a macro level with the publicly traded infrastructure companies.

So what’s driving the performance of the index?

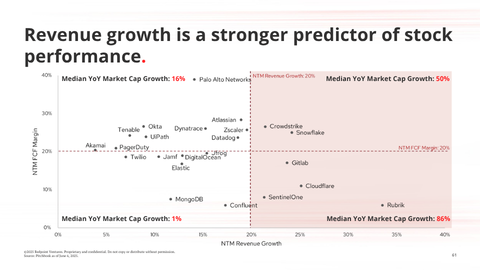

The above chart shows the 23 companies in our index plotted by their NTM revenue growth and NTM FCF margin and splits it into 4 quadrants by NTM revenue growth higher than 20% and NTM FCF margin of 20%.

Companies growing faster than 20% YoY as shaded in the red generate far stronger returns than those growing less than 20%.

Being more profitable doesn’t drive stock performance as much as revenue growth does.

But an interesting stat... there’s only one company growing revenue faster than 30% YoY which is Rubrik

To hit rule of 40, companies like Snowflake, Crowdstrike, an Zscaler have a healthy balance between top-line revenue growth and FCF margin.

And we can see this in practice…

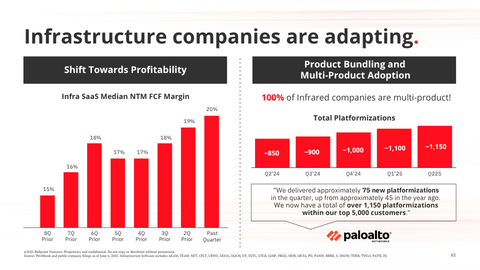

When we look at the cohort of infrastructure software companies, they have never been more profitable, as the median FCF margin is 20% which is a record-high.

And 100% of the infrared companies are all multi-product. While maintaining profitability, they are still innovating and trying to maximize their TAM and as a result top-line revenue growth.

But the age old question - where will value accrue this time?

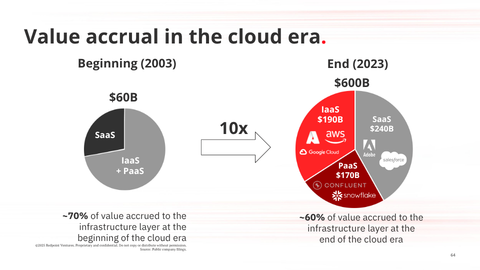

Let’s go back and look at what happened during the cloud era.

At the beginning of the cloud transition, 70% of value accrued to the infrastructure layer.

Over 20 years of the cloud platform shift, that figure came down to 60% indicating that the net new spend was mostly captured by application software companies.

But at the end, cloud infrastructure captured the majority of the pie.

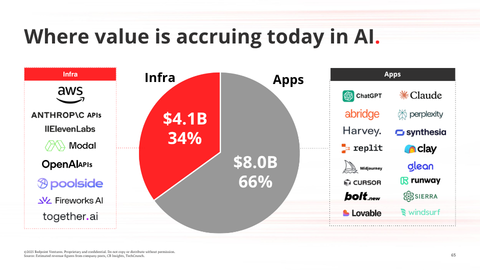

When we look at what’s happening in AI, it’s flipped

Two thirds of spend has been captured by AI apps like ChatGPT, Glean, Abridge, and Harvey.

One third has been captured by model infra and AI infra companies like Anthropic, Poolside, and Modal.

So will the same happen during the AI era?

It’s hard to apply the same framework and lens to what we observed with cloud to what will happen in AI. It might be the opposite and it’s clear that app companies have a big headstart, 2x to be exact.

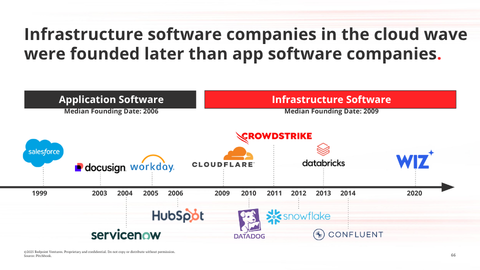

What we do know from the last transition is that the majority of SaaS companies came before infrastructure companies.

The median SaaS company was founded in 2006 while the median infra company was founded in 2009.

That’s because SaaS companies had to be running at massive scale, pushing the limits of their cloud rails before innovation could happen at the infrastructure layer to enable that kind of consumption.

We suspect the same with AI - we will need to see AI app companies like Harvey and Abridge reach massive scale, pushing the limits of the underlying models and AI infra, before it’s clear what is going to stick in the land of infrastructure.

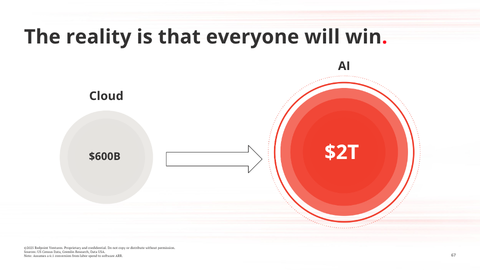

Taking a step back, thinking of infra vs apps is dumb because…

We think everyone will win.

The end market we’re all building in is MASSIVE.

Cloud grew to a $600B market by the end.

Initial estimates are that AI will grow to a $2T market in actual spend.

Taking 30% of this for infra implies a market as big as all of cloud itself.

So we think that all builders will win.

Why is the AI market so much bigger?

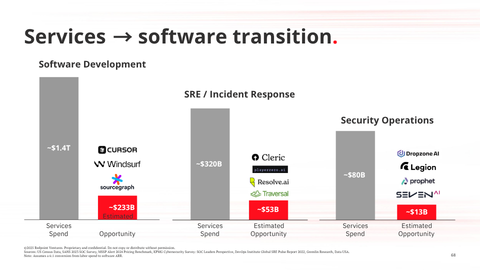

Well there is a massive services to software transition happening.

Previous infrastructure markets like Software Engineering, Incident Response, and Security Operations which historically have been human and services driven will convert to product software revenue.

LLMs and agents enable this transition and can encapsulate complex workflow with software

And these services markets are enormous. The developer market alone sized with [ ] assumptions is a 1.4T market in spend. Incident response is over $300B.

A key question is what the conversion will be from services to software revenue. It definitely won’t be 1:1. Initial data points suggest a 1:5 or 1:6 conversion.

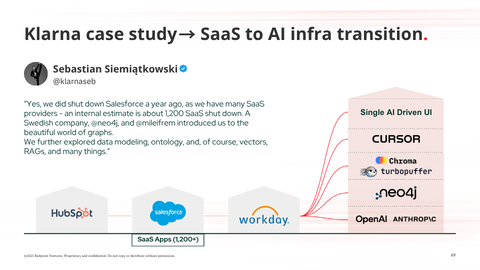

Another interesting dynamic is what’s happening internally at the largest of companies.

Klarna has been in the headlines often for the AI strategy.

Internally, they have moved away from SaaS vendors like Salesforce and Hubspot and have created a Jarvis-like system, one comprehensive single AI that captures all the nuances and data of the company internally.

What’s interesting is that they have primarily used AI-native infra to enable that transition.

Previous application software data is now captured in Neo4j - a graph DB as well as several vector DBs. Front ends are made on the fly through Cursor which is powered by Anthropic and OpenAI’s models.

All of this app software spend has been converted to infra software spend.

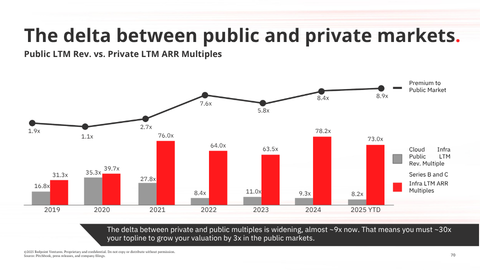

The above data is stunning. It shows the dynamics at play between the public and private markets within infrastructure software.

What we’re showing here in the grey bar is the median LTM revenue multiple for public infrastructure names. And the red bar is the median LTM ARR multiple for private infrastructure deals, specifically the comps for tier 1 companies like those in the InfraRed100.

The red bar should get you excited, but the grey bar should give you pause.

Now more than ever, there is a wide spread between revenue multiples in the public markets and those in the private markets. It’s nearly 10x.

So why does this matter? Well, there’s a potential danger zone when you take that attractive term sheet.

Your valuation needs to converge to those grey bars, because that’s how you will be traded in the public markets.

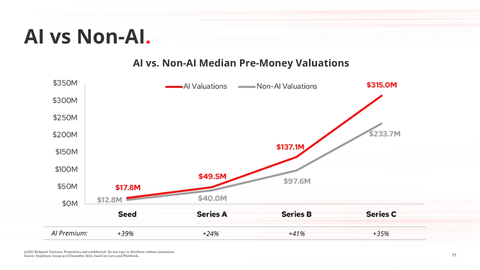

When we split the private valuation data by AI deals and non-AI ones, there is a clear premium

The above chart shows the median pre-money valuations for AI companies and non-AI ones from the seed through the Series C.

Series B and C AI deals are 40% more expensive than non-AI ones.

We’re showing you this data because you need to consider your growth expectations carefully. Higher valuations can increase pressure on future growth and operations…

And there is a gravitational law in terms of how you will be traded in the public markets.

So what does this mean for you?

- Maximize your TAM. You need to be in a big market that will allow you to grow and expand. It's normal for your initial product and market opportunity to be modest, but it's crucial that you develop additional products and have the foresight to launch them at the right time to build a true platform.

- By the time you go public, you need to converge to ~40% in terms of the rule of 40, ensuring a clear path to profitability. This doesn't mean sacrificing growth for profitability in the earlier stages if you are outperforming your plan.

- We’re not here to tell you to get to cash flow break-even and cut costs. But we do want you to understand that the bar is really high now and getting even higher.

- The game you're all playing is that you’re a high-performance company and you have a real shot at being public but you’re going to burn a lot to grow really fast.

- But as you mature, you need to generate meaning FCF and you need to converge on profitability… eventually. It’s important that you’re building a business that is durable.

- At the same time, you need to set yourself up for success and be realistic with valuations. There is a major delta between private and public markets. When raising your next round, consider your growth expectations carefully.

- On AI, it’s so clear that you need to be building with AI as a tailwind. It’s undeniable what’s happening across the AI world and how massive the opportunity is.

- You can either sell directly or expand your product suite with a use case that targets an existing market characterized by a lot of human labor / services work.

- Or up-level your existing product with AI-native features. You’re collecting critical data from your customers and their workflows - you can leverage this data in very unique ways with the model providers to extend your existing products with AI and delight your customers.

- Finally, it’s never been so competitive in startup land. You have to be aggressive, all the time.

- You have to ship product before your competitors do

- You have to be obsessed with your customers, building and listening with them

- You have to be the first to forge strategic partnerships

- This all leads to brand and first mover advantage which compounds over time

- You need to suck the oxygen out of the room in these dynamic, extremely competitive markets

Read the full InfraRed Report here.